How Government Gets Paid

For my entire adult life, I have heard that the single most pro-business government action is to lower taxes. Lowering taxes, the argument goes, allows businesses to invest, innovate, and grow.

Logically, it makes sense. But is it true?

Jason Furman, a leading economist at Harvard, makes a strong case refuting the tax-cuts-equal-growth logic. In his testimony before the House Ways and Means Committee, which you can read here, Furman makes the following points:

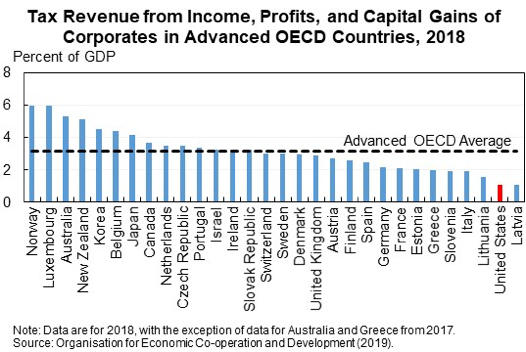

US corporate tax revenue — the amount of taxes that the government receives from businesses — is at the lowest levels since the 1930s

Outside of Latvia, US corporate tax revenues are the lowest among advanced economies

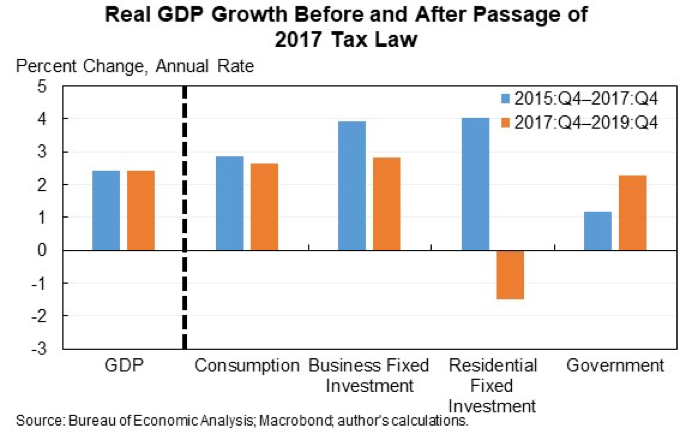

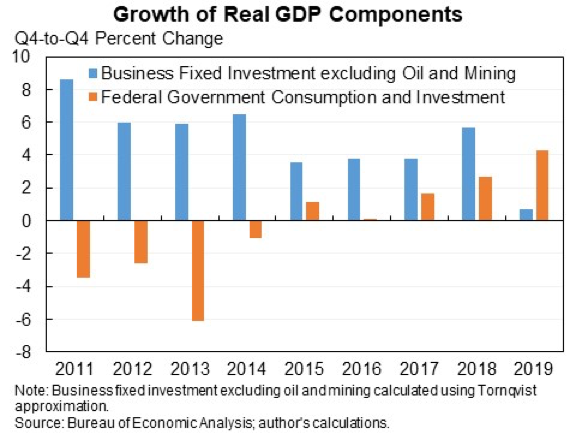

The 2017 tax law did not boost growth; in fact, post-tax cut, business investments and consumer spending slowed — but government spending grew

Business and Government investments can crowd out each other

It’s worth pointing out that, with taxes, there are several distinct yet interconnected issues at play.

The first is tax levels. Rates – a highly ideological issue – take up most of the oxygen in the tax conversation.

The other critical issues are classification, collection, and enforcement. What is counted in – and what is excluded from – corporate taxes? How does the government collect the taxes owed to it by corporations? And how does the government establish a system that can enforce the policies of classification and collection?

Lastly incentives. Never discount incentives.

Furman summarizes his solution this way:

The key insight motivating my proposal was that much of the economic efficiency associated with the business tax code depends on the tax base and not on statutory tax rates. With a reformed tax base that expands incentives for new investment as well as for R&D it is possible to increase statutory tax rates in a way that raises more revenue from past investment decisions and their future profit windfalls (i.e., the so-called “supernormal” return) while cutting the tax rate on the portion of the return that businesses use in evaluating whether to make new investments or undertake R&D (i.e., the so-called “normal” return). This is the opposite of the traditional tax reform mantra to broaden the base and lower the rates.

You can read more in his new paper.