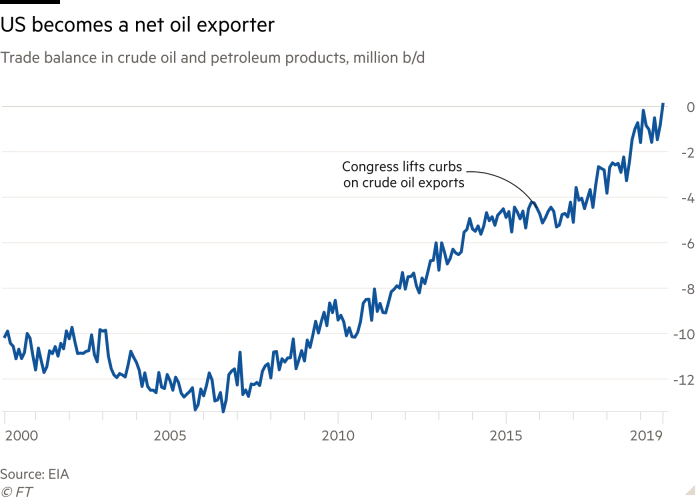

Not Since the 1940s

For the first time since the 1940s, the US is exporting more oil than it is importing. This is stunning, rapid reversal.

As recently as George W. Bush's presidency, America's expansive thirst for oil and gas was satiated by foreign governments. Canada (43% of total), OPEC, and Persian Gulf countries were happy to be our suppliers.

In 2007, right before the financial crisis, the US imported roughly 14 million barrels of oil per day. That's a lot of fuel.

Since 2009, though, domestic production has dramatically expanded. Output boomed throughout the Obama years – don't tell the radicals – and has continued to increase since Trump took office.

The Fracking Revolution

Significant increases in fracking and shale exploration have powered this turnaround. As I wrote in September:

Texas is projected to produce forty billion barrels of new oil (or equivalent) in the next ten years. By contrast, Russia – a country whose entire economy depends on oil and gas – will produce just four billion barrels. Same for Brazil.

Because of our countrymen's love of big cars and overall consumption, oil is a main driver of America's trade deficit. The oil deficit alone – $62 billion in 2018 – accounted for ten percent of the overall trade deficit.

Some (though not all) of the benefits of increased production get passed on to the consumer; as more oil reaches the market, the price goes down. Anyone who has driven for years has experienced this drop.

In 2011, the average price of gasoline was $3.57. By 2018, that number had dropped to $2.46.

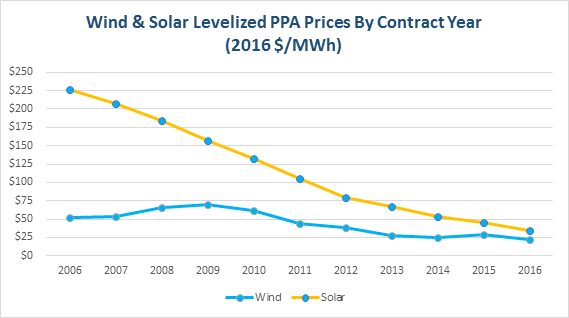

By itself, significant increases in oil production – from new sources – would create adverse incentives related to climate change. When prices are high, it's easier to make the case to switch from world-killing to renewable sources.

Something else is happening simultaneously, though. The prices of alternative sources of energy are dropping precipitously. Between 2006 and 2016, the cost of solar panels decreased by 10x. This price drop led to an 800% increase in home-based solar production.

How will this play out moving forward? There are several plausible scenarios.

One unlikely scenario has demand staying steady or declining. In this case, oil and renewables will be competing to provide reliable energy at increasingly attractive prices.

Another scenario is that governments intervene — through rationing or regulation — in the oil market. This will drive up the price of oil and, in theory, decrease the cost of renewables. Once renewables are cheaper and, importantly, as reliable, people will naturally make the switch.

The third scenario

A third scenario is most likely.

The world’s population, especially in developing countries, will continue to grow. Our energy needs will increase — significantly. More people will need more energy.

In response, supply – oil and renewables – will increase output to meet demand. The earth will continue to bake as billions of people require ever-more energy for transportation, air conditioning, always-on technology, and all the trappings of modern living.

The US is now, officially, a net oil exporter. The economics of this new reality are positive. The consequences – burn, baby, burn – are more complicated.