Why Price Matters

Warren Buffet is frustrated.

He wants to make an "elephant-sized" investment, but for the notoriously frugal investor, stocks are priced too high to justify it.

His frustration – like cost itself – is relative. What you pay will determine what you make.

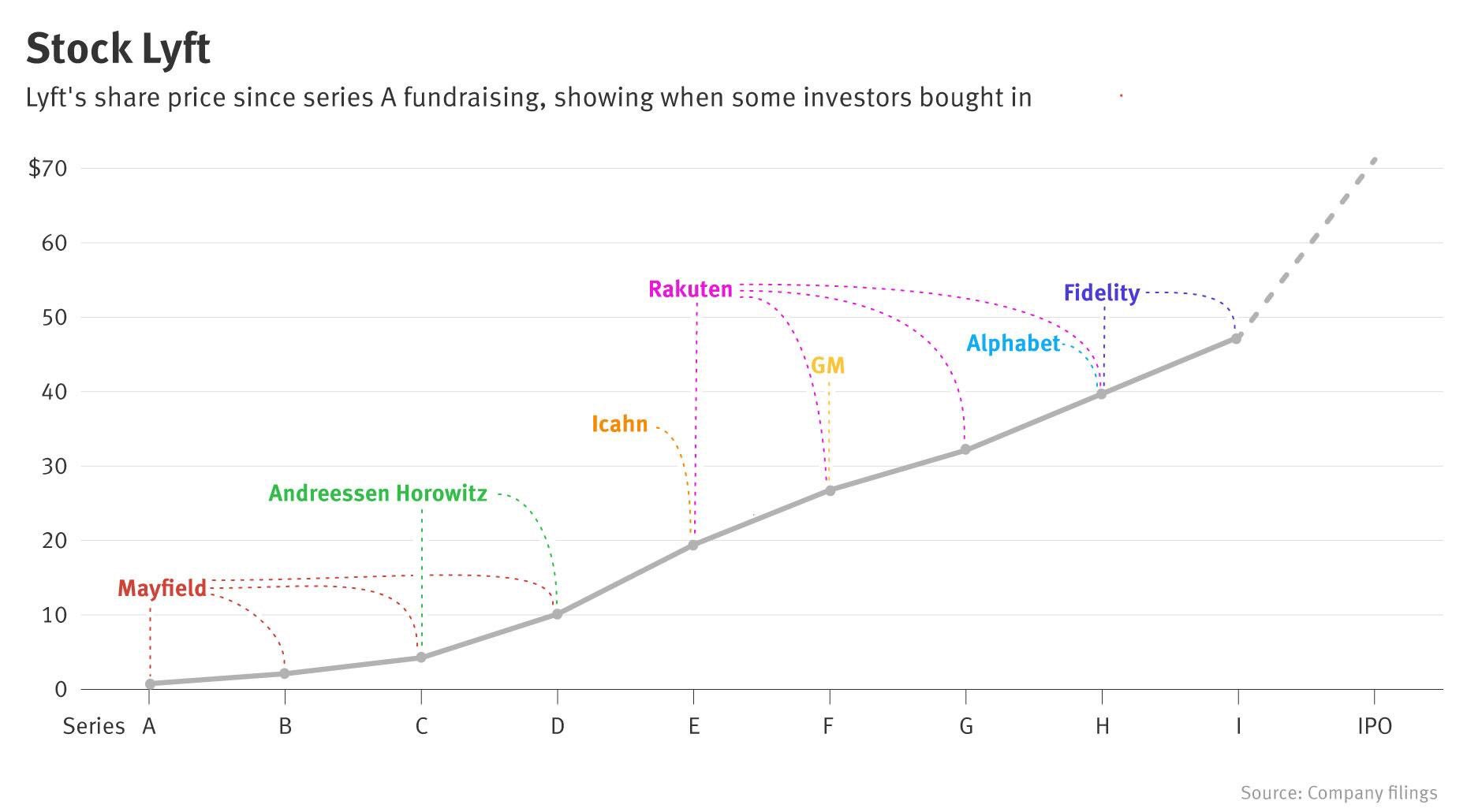

On March 29th, Lyft shares were selling for $78. On that day, all of Lyft's private market investors were generating positive investment returns.

Lyft stock has since dropped by ~25%.

If Lyft shares drop by another $10, Fidelity – which owned ~8% at IPO – would be losing money on its Lyft investment (assuming it held). If the stock falls by an additional $10, Google's investment would be underwater.

Here's why: relative to Lyft's other private investors, Fidelity and Google bought high and late.

When Lyft was getting started, its investors were not paying forty, fifty, or eighty dollars per share. In some cases, investors were buying Lyft shares for less than a cup of coffee.

In 2011, Mayfield invested in Lyft at 76 cents per share. At the time of Lyft's IPO, Mayfield would have returned 4280% on its Lyft investment.

Four years later, Andreessen Horowitz invested in Lyft at ~$4.25 per share. At the time of Lyft's IPO, A16Z would have returned 1000%.

Pricing is essential to more than investing.

The cost of housing significantly impacts personal finances. The same is true for the cost of education, the cost of debt, and the opportunity costs of our decision-making.

Whenever possible, find low price, high-value opportunities.

Between Mayfield and Fidelity, Lyft shows us why.