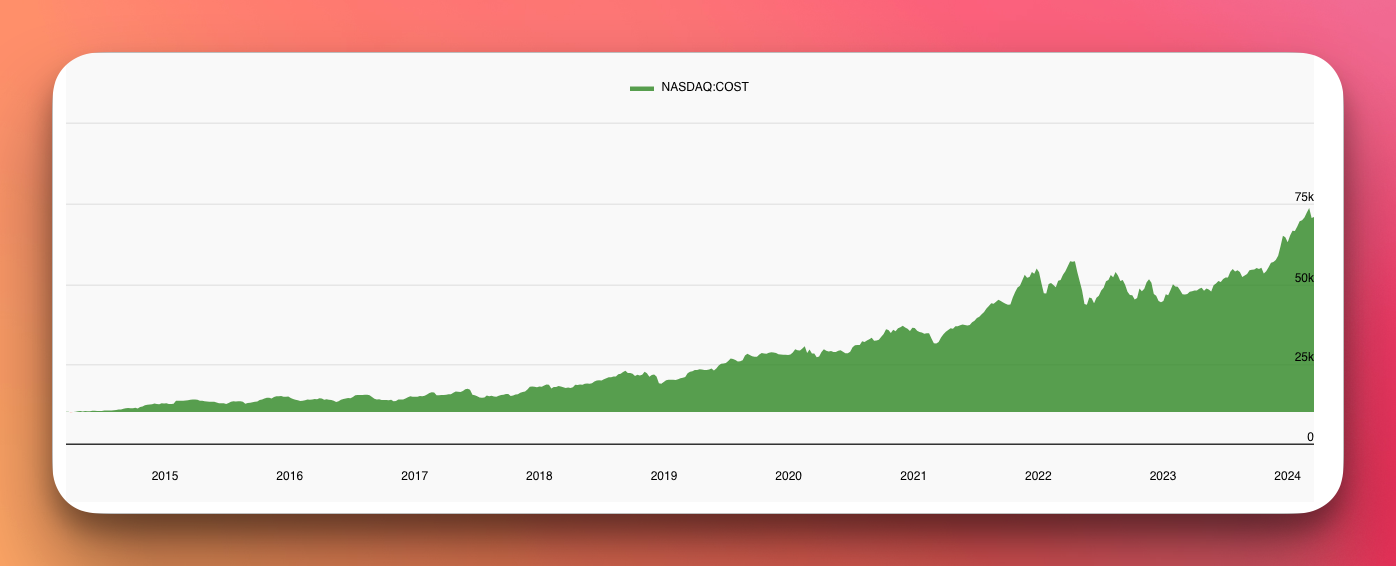

By The Numbers: Costco

Costco is a prime example of the power of compounding gains, a powerful concept that involves earning returns on both your original investment and on returns from that investment. This principle can be applied to other areas of strategic operations, including long-term investments in adherence to customer focus, employee retention, and corporate culture, among others.

Grounded in its values and business model, Costco has generated compounding gains for decades, as detailed below.

Forty years ago this past September, the first Costco warehouse opened in Seattle. We grew to nearly three billion dollars in sales in less than six years. Our operating philosophy then and now remains simple: provide our members quality merchandise and services at the lowest possible prices. We achieve this through our commitment to carrying out our mission statement and adhering to our code of ethics.

The successes and challenges we faced in fiscal year 2023 reinforced the foundational business model of Costco, focusing on the most productive items and bringing quality goods to market in volume. Although we experienced inflationary pressures and general economic uncertainties, our buying and operations staff ensured that quality and value remained priorities.

20 Year Horizon

| Start Date | Mar 18, 2004 |

| End Date | Mar 18, 2024 |

| Start Price/Share | $31.65 |

| End Price/Share | $731.54 |

| Total Return | 2,211.40% |

| Compound Annual Growth Rate | 17.00% |

| Starting Investment | $10,000.00 |

| Ending Investment | $231,140.34 |

| Years | 20 |

10 Year Horizon

| Start Date | Mar 18, 2014 |

| End Date | Mar 18, 2024 |

| Start Price/Share | $103.21 |

| End Price/Share | $731.54 |

| Total Return | 608.76% |

| Compound Annual Growth Rate | 21.63% |

| Starting Investment | $10,000.00 |

| Ending Investment | $70,875.54 |

| Years | 10 |

5 Year Horizon

| Start Date | Mar 18, 2019 |

| End Date | Mar 18, 2024 |

| Start Price/Share | $230.55 |

| End Price/Share | $731.54 |

| Total Return | 217.30% |

| Compound Annual Growth Rate | 25.97% |

| Starting Investment | $10,000.00 |

| Ending Investment | $31,730.07 |

| Years | 5 |